Armstrong: Will Gold Reach $5000?

Labels: economic crisis, gold, Martin Armstrong

* In Aurum Securitas *

Modern economics is not rocket science.

In fact, it's not science at all. It's a game, a confidence game.

Once paper passed for money, economics became an elaborate

shell game designed to hide the fact paper had been substituted for silver and gold.

The shell game is called "Where's The Money?"...

The answer is simple, it's not there.

Labels: economic crisis, gold, Martin Armstrong

Labels: devaluation, Egon von Greyerz, financial crisis, gold, silver

Labels: Antal Fekete, financial crisis, GATA, gold, gold standard

Labels: Antal Fekete, financial crisis, gold, gold standard, money

"Global consumption fell 8.6 percent to 719.5 metric tons from a year earlier, the London-based industry group said in a report today. That's the lowest level since the first quarter of 2003. Jewelry demand declined 22 percent and electronics, the biggest industrial use for gold, slid 26 percent."

This sounds pretty dire, doesn't it? This means that global demand for gold fell67.7 tonnes.

But wait a minute! There is this little gem. ...

"Central banks bought 14 tonnes of gold more than they sold, the first quarterly net purchases since at least 2000, according to the council, based on figures from London-based research company GFMS Ltd. The so-called official sector had net sales of 69 tonnes in the second quarter last year, the report said. Wozniak said GFMS wouldn't identify any of the buyers. Central bank purchases aren't counted in the 719.5 tonnes of total demand because they are considered a traditional source of supply, she said."

You have got to be kidding me! Net buyers aren't counted as demand because traditionally they are sellers!

That is just the most contrived reporting to come up with the negative gold news GFMS always wants to produce. This means that the change in demand from the central banks, going from selling a net 69 tonnes to buying 14 tonnes, is a positive difference of 83 tonnes. This means that global demand for goldincreased by 2 percent, instead of declining 8.6 percent.

Now why would an industry group that is supposedly meant to be a pro-gold advocate want to turn a 2 percent growth in demand to an 8.6 percent decline?

We can rule out an honest mistake because this is the ultimate in dishonesty: ignoring central bank demand. It is not the first time either. GATA has long criticized GFMS for its reporting of gold market statistics, particularly with respect to its ridiculously low gold loan numbers. GFMS failed to report the 450 tonnes of gold accumulated by China over the last five years, while GATA had sources that revealed not only the buying but the quantity as well.

But this is not the only nonsense in GFMS statistics. There also is this:

"Other such sources showed gains, including a 6 percent rise in mine production from the second quarter of 2008, and a 21 percent jump in recycled metal, the report said."

A 6 percent increase in mine supply? Here is the news from the third-biggest gold producer in the world, South Africa:

http://www.dispatch.co.za/article.aspx?id=337268

"In June 2009 the country's gold output fell 12.2 percent compared with the same month last year. South Africa is the world's third-largest gold producer, behind China and the United States."

China's production did increase by 13 percent. However, although South Africa is the third-biggest producer at 220 tonnes, it is not far behind China, which produces 280 tonnes. So this means that gains in China's gold production are roughly offset by declines in South Africa's. So where did 6 percent total worldwide gold mine output growth come from?

Newmont Mining, the world's biggest gold mining company, increased production by a meager 1.2 percent, while Anglogold Ashanti saw a 10 percentand reduced hedges by 1.4 million ounces in the quarter, which further reduced supply to the gold market.

A 6 percent growth in gold mine output is a fabrication.

The gold price has been suppressed by the gold cartel such that the price is at or below the cost of production. This is not an incentive to grow; it is the exact opposite.

GFMS has a hidden agenda and deliberately misreports gold market information. Could the firm's motivation possibly be aligned with the gold cartel? It would be interesting to know who funds GFMS' research.

* Adrian Douglas is publisher of the Market Force Analysis letter (http://www.MarketForceAnalysis.com) and a member of GATA's Board of Directors.

Labels: Adrian Douglas, GATA, market manipulation

Financial market letter writer Adam Hamilton's latest essay, "Central Bank Gold Agreement," which can be found at Gold-Eagle here --

http://www.gold-eagle.com/gold_digest_08/hamilton081409.html

-- and at GoldSeek here --

http://news.goldseek.com/Zealllc/1250269200.php

-- is a fairy tale.

Hamilton writes that central banks are just investors in gold like everyone else.

What Hamilton and most people overlook in analyzing central bank gold sales is that they are a farce that beats the best Monty Python sketches. The central banks have printing presses and now computers that can generate loads of fiat money. It is beyond side-splittingly funny that we should take central banks seriously that they need to sell gold in exchange for the stuff they manufacture for free.

Can you imagine the Saudis selling oil in exchange for sand, or Eskimos selling fish in exchange for ice, or Paul McCartney selling an apartment in London in exchange for a Beatles poster autographed by himself? Yes, you think those examples are funny, don't you? So why not have a big fat laugh at a central bank selling its gold for the funny paper it produces in infinite quantities?

Central banks run the world's biggest Ponzi scheme, issuing bits of paper that people will accept in return for real goods and services. If you enjoyed this privilege to the tune of a few trillion dollars that finance an empire, expending a few tonnes of gold to keep it going would be a no-brainer.

Central banks do not sell gold to get a few billion of their own fiat money in return, money they probably would throw on top of the stack of half a trillion freshly printed notes that rolled off their presses just that morning. No, central banks sell gold to make it appear that the paper stuff is more desirable than its true supply and demand fundamentals would allow. And when the game looks like it's coming to an end, the central banks can always buy back the gold.

It is not a problem to buy back the gold at even $50,000 per ounce when any amount of paper currency can be printed.

What is a big problem is if the currency loses its value so fast that no one will sell the central banks any gold for any amount of paper. (Try buying gold with Zimbabwean dollars.)

If that happens, the central banks lose and the people win, because when the music stops the people have the gold and the central banks are stuck with the depreciating paper.

Central banks have to use their gold to support their Ponzi paper creation, but they have to control the destruction of their currency's purchasing power so they can still buy their gold back with their own paper before the game ends and they have to start a new one.

When the paper currency has little purchasing power left but the central banks have bought back their gold, they can introduce a new currency and start the cycle all over again.

In this way they leverage their gold instead of having something honest like one-for-one backing in a classical gold standard. They have even found ways of having more leverage by selling paper promises for gold to make it look as if they have 10 or 20 times as much gold as they really have.

There is another problem. What if someone else with a large amount of worthless paper currency gets the idea to buy back your gold before you do?

Do you ever wonder why China kept so quiet about the 450-tonne increase in its gold reserve over the last five years? Clearly China would not want to tip off the Western central banks that it was going to beat them at their own game. If China has admitted to acquiring 450 tonnes of gold, it probably has a lot more than that.

This is all about world dominance. Whoever has the most gold is king.

Is it any surprise that GATA has been denied its Freedom of Information Act requests to the Federal Reserve and Treasury Department about the U.S. gold reserve? We asked to see how the magician does his tricks. We have been told that this is a "trade secret." You betcha it's a "trade secret"!

Labels: central banks, GATA, gold

Labels: gold, market manipulation

Have you heard the great news? The recession is over! It's true; I saw it on TV. Why fret about growing unemployment lines when banks are paying big-time bonuses again?

Proof of the turn was apparently revealed by the 2nd quarter GDP figures that showed that the economy declined by only 1%. After four consecutive quarters of negative GDP, the green shoots now assume that growth will resume over the summer. But before we pop the corks, it may be worthwhile to ask, "what really has changed, and what is responsible for our new lease on life?"

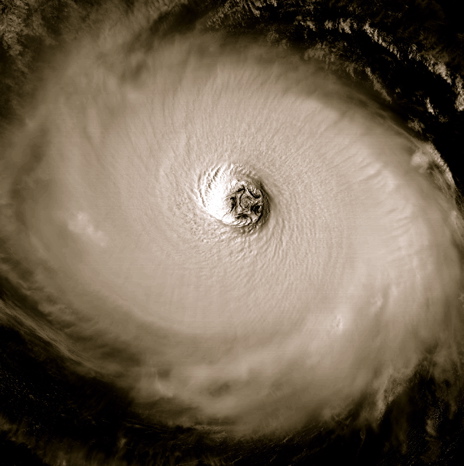

In truth, because of the continued profligacy of the government and Federal Reserve, the imbalances that caused the current recession have actually worsened. We are now in an even deeper hole than when the crisis began. Rather than wrapping up a recession, we are actually sinking into a depression. If things look better now, it's just because we are in the eye of the storm.

We must remember that recessions inevitably follow periods of artificial growth. During these booms, malinvestments are made which ultimately must be liquidated during the ensuing busts. In short, mistakes made during booms are corrected during busts - and in the recent boom we made some real whoppers. We borrowed and spent too much money, bought goods we couldn't afford, built houses we couldn't carry, and developed a service sector economy completely dependent on consumer credit and rising asset prices. All the while, we allowed our industrial base to crumble and our infrastructure to decay.

In order to lay the foundation for real and lasting recovery, market forces must be allowed to repair the damage. However, current policy is counterproductive to this end. Trillions in stimulus dollars have kept the party going, but now what? How does deficit spending by the government address the problems that brought about the crash? It doesn't; it just delays and worsens the hangover - and we have to hope we don't die of alcohol poisoning.

By interfering with the unpleasant forces of the recession, we simply trade short-term gain for long-term pain. By propping up inefficient companies that should fail, we deprive more effective companies of the capital they need to grow. By holding up over-valued asset prices, we prevent the prudent or less well-off from snatching them up and, in doing so, creating a new price equilibrium based upon reality. By maintaining artificially low interest rates, we discourage the very savings that are so critical to capital formation and future economic growth. In addition, the false economic signals the Fed sends the market prevent a more efficient re-allocation of resources from taking place and leads to even more bad economic decision being made. By running such huge deficits, we further crowd-out private enterprise by making it harder for businesses to invest or hire.

The recently passed "cash for clunkers" program (currently on-hold, as it ran out of funding in one week) is a perfect example of how government policy can make the economy worse. By incentivizing Americans to destroy fully paid-for cars so they can go deeper into debt buying brand new ones, the government weakens an already crippled economy. The last thing we want to do is subsidize Americans to go deeper into debt by buying more stuff. Don't they realize that is precisely the behavior that got us into this mess?

Think about it this way. If your friend were in trouble because he had too much debt, would you encourage him to take on even more? Wouldn't a real sign of progress be a reduction of debt, even if he had to cut back on his everyday expenses? What is true for an individual is also true for a collection of individuals, even if they call themselves a 'government.' If, as a country, we are even deeper into debt now than we were before, we are worse off. Period. The fact that the additional debt enabled better short-term GDP numbers is a long-term negative.

Since we have learned nothing from past mistakes, we are condemned to repeat them. As if we have not already suffered enough as a consequence of the Bush/Greenspan stimulus, Obama/Bernanke are giving ever larger doses, which will prove lethal to any recovery.

The recession is over; long live the depression!

###

For a more in depth analysis of our financial problems and the inherent dangers they pose for the U.S. economy and U.S. dollar denominated investments, read my latest book "The Little Book of Bull Moves in Bear Markets." Click here to buy it now.

More importantly, don't wait for reality to set in. Protect your wealth and preserve your purchasing power before it's too late. Discover the best way to buy gold at www.goldyoucanfold.com, download my free research report on the powerful case for investing in foreign equities available atwww.researchreportone.com, and subscribe to my free, on-line investment newsletter.

Labels: financial crisis, Peter Schiff

Labels: mint